In real estate, timing is everything. For real estate agents working with investors, having access to fast, flexible financing can mean the difference between closing a profitable deal and missing out. That’s where Fix and Flip loans come in —they provide your clients with the funding they need to secure, renovate, and sell properties quickly.

Understanding how Fix and Flip loans work and recommending them to your clients can set you apart as a valuable resource. It’s not just about closing deals; it’s about helping your clients succeed—and that’s good for your business, too.

About Fix and Flip Loans

Fix and Flip loans are short-term financing solutions designed to help investors purchase and renovate properties quickly. Unlike traditional mortgages, these loans prioritize the after-repair value (ARV) of a property, making them ideal for projects that involve transforming distressed properties into high-value homes.

How LendSure Home Loans Supports Real Estate Agents and Their Clients

LendSure Home Loans offers Fix and Flip loans for real estate agents as a way to help their investor clients succeed. These loans provide:

- Quick Approvals: Investors can secure an approval typically in hours, not days, helping them act fast in a competitive market.

- High Loan-to-Cost Ratios: Financing covers up to 90% of the purchase price and 100% of renovation costs.

- Flexible Terms: Interest-only payments during renovations help keep cash flow manageable for your clients.

- Focus on Property Potential: Loans are based on the ARV of the property, making them accessible to more investors.

By connecting your clients with lenders like LendSure Home Loans, you can help them secure the financing they need to make successful property flips.

Why Fix and Flip Loans Matter to Real Estate Agents

Fix and Flip loans offer significant benefits that can enhance your ability to close deals and grow your business.

- Faster Transactions

Time is often a critical factor in real estate. Fix and Flip loans provide fast funding, enabling your investor clients to close on properties quickly. As a real estate agent, this speed means fewer delays and smoother sales.

- Expanded Opportunities

With financing available for distressed or undervalued properties, your clients can take on projects they might otherwise pass up. This opens the door to more deals—and can lead to more commissions for you.

- Enhanced Client Relationships

By recommending financing options like Fix and Flip loans, you position yourself as a knowledgeable resource. This builds trust with your clients and increases the likelihood they’ll return to you for future deals.

- Higher Property Values

When your clients renovate and resell properties, the improved home value can elevate the market in your area, benefiting your future listings.

How Fix and Flip Loans Work

Understanding the loan process can help you better advise your clients and manage expectations. LendSure’s Fix and Flip loans for real estate agents feature a streamlined process that gets investors from application to funding quickly:

- Apply: Investors submit a short, simplified loan application.

- Receive Term Sheet: LendSure provides a clear breakdown of the loan terms.

- Submit Documentation: Clients return the signed term sheet along with additional loan documents.

- Collaborate: LendSure’s Account Executive works with the investor and loan officer to meet conditions and complete the appraisal.

- Close the Deal: Once the loan is approved, funding is disbursed, and the client can start renovations.

How Fix and Flip Loans Benefit Your Clients—and Your Career

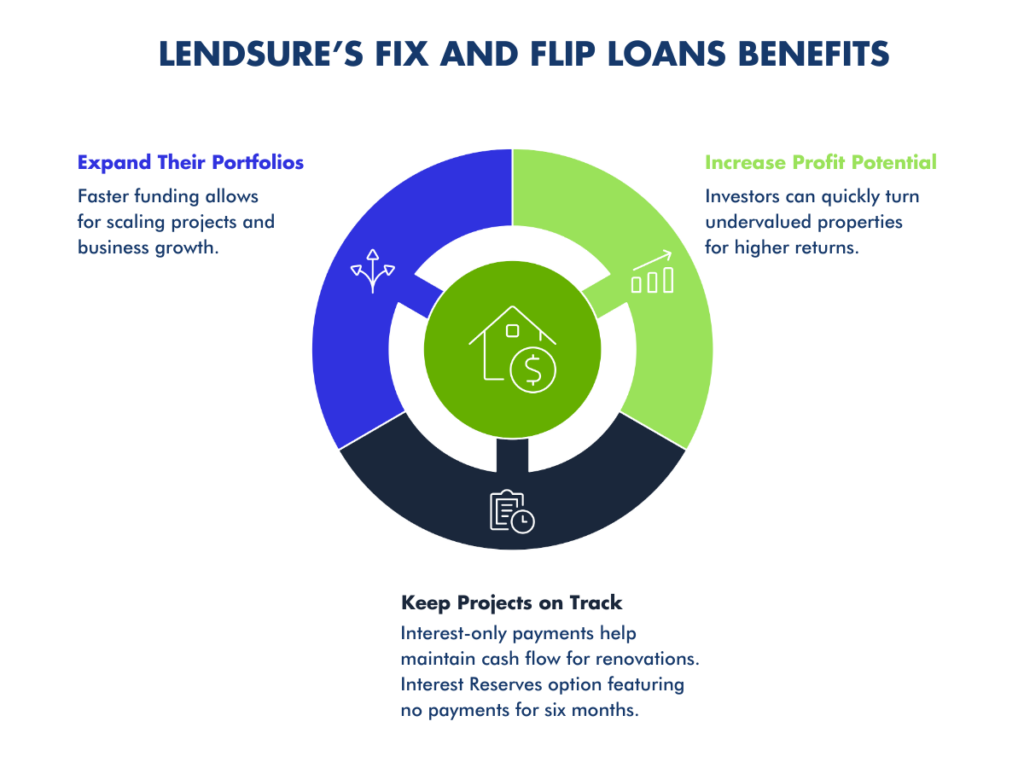

By introducing your investor clients to Fix and Flip Loans for Real Estate Agents, you’re helping them take advantage of financing that can:

- Increase Profit Potential: Investors can quickly turn undervalued properties, sell them for higher returns, and reinvest in new opportunities.

- Keep Projects on Track: With interest-only payments during renovations, clients can maintain cash flow for unexpected expenses.

- Expand Their Portfolios: Faster funding allows investors to scale their projects and grow their real estate business.

For real estate agents, this means more closed deals, higher commissions, more repeat business, and a stronger reputation as a go-to expert for investor clients.

Why Real Estate Agents Recommend LendSure Home Loans

LendSure Home Loans offers tailored Fix and Flip loans for real estate agents and their clients, making it easier for you to help investors navigate the challenges of property flipping. Their quick approvals, flexible payment structures, and high loan-to-cost ratios give your clients the tools they need to succeed.

Partnering with LendSure helps you build trust with your clients, stand out in your market, and stay top of mind for future business opportunities.

LendSure Home Loans As Your Solution

It’s simple. We make loans that make sense. We’re not in-the-box lenders. Of course, there are numbers, ratios, and data to consider, but we know that behind every file, there’s an individual with unique circumstances seeking a loan.

We’re redefining the mortgage experience one loan at a time. Thanks to our common-sense approach and dedicated lending team, we say ‘yes’ more often to today’s homeowners and investors.

Contact us today to learn more about our Fix and Flip loans.